The late 19th and early 20th centuries marked a “golden era” of

manufacturing in the developed world that contributed to the

largest increases in living standards in recorded history. This

was initially fuelled by huge productivity improvements in

agricultural production that allowed for significant migration

of labour into the manufacturing sector. Manufacturing itself

had already been transformed by the industrial revolution that

began in the UK a century before. It was further transformed by

mechanised mass production into a highly productive sector that

offered rising wages with which to purchase the increasing

variety of manufactured goods on offer. The result was an

increase in manufacturing’s share of total output across the

developed world through the first half of the 20th century.

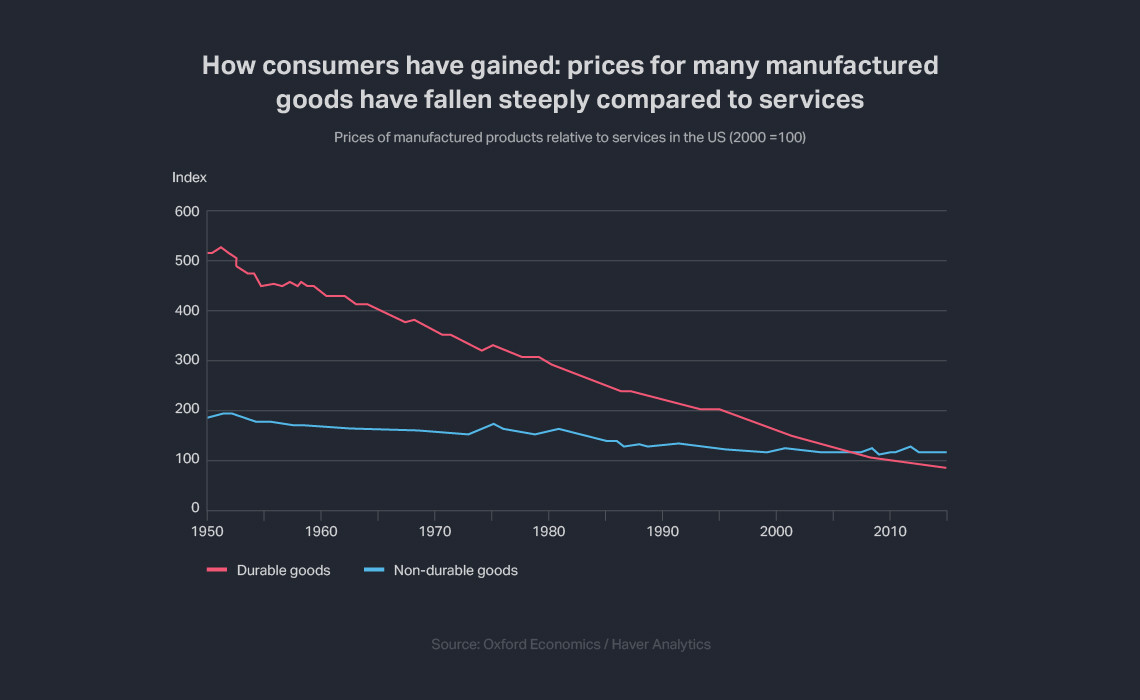

As a result of manufacturing breakthroughs, the prices of a

wide variety of goods have fallen, greatly benefiting consumers

Since then, the economic footprint of manufacturing has shrunk

in relative terms in most of the rich nations. In some cases,

the changes have been dramatic. At the same time, productivity

gains within manufacturing have outpaced the economy as a

whole, lowering the cost of manufactured goods and allowing

labour to migrate to the service sector. At this stage of

development, the share of manufacturing within an economy

typically declines as growth in the service sector outpaces

manufacturing, which may or may not be contracting itself.

So there is a sense in which manufacturing is a victim of its

own success. The cost of manufactured goods relative to

services has plummeted in the past 50 years, making an

increasing variety of products more affordable and freeing

households’ income for spending in other areas. This has led to

saturation in some developed markets. In much the same way that

agriculture can now provide for global food requirements with

less than 5 per cent of global economic activity, manufacturing

can satisfy global demand for goods despite accounting for less

than 20 per cent of global output.

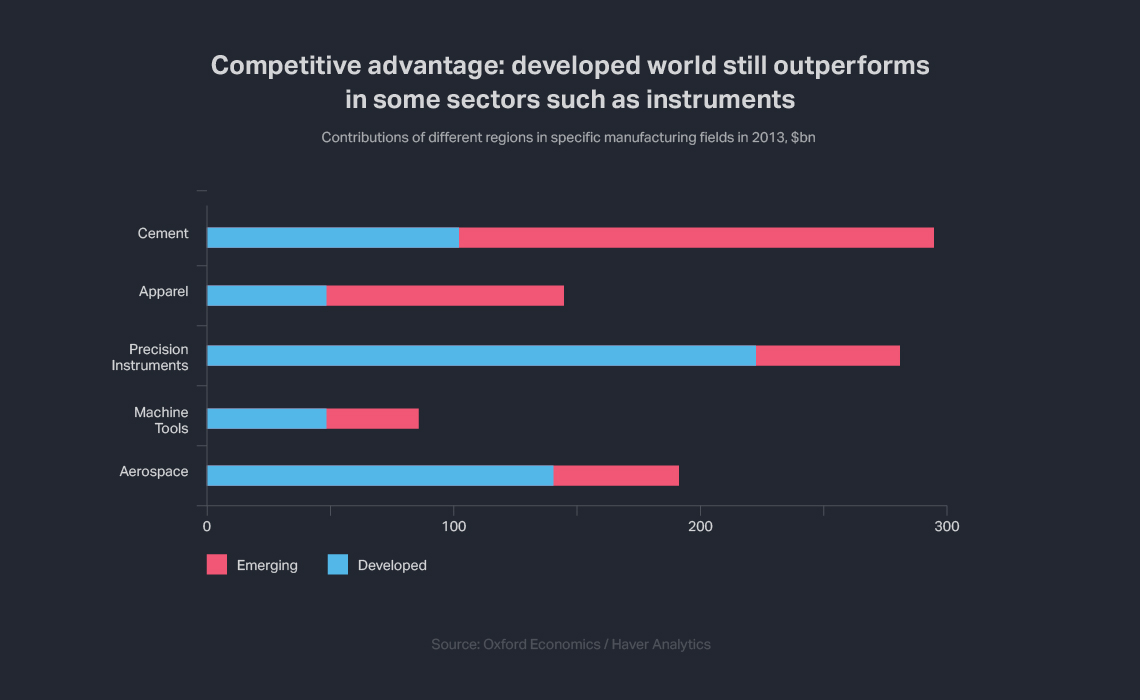

Despite its diminished footprint, manufacturing in the

developed world continues to flourish mainly because these

countries have the skills and technical know-how to support

sophisticated high-value engineered products such as aerospace

equipment and precision instruments. The growth of

manufacturing in the emerging world has been driven much more

by relatively unsophisticated manufacturing, in areas such as

basic clothing and building materials. In developed

countries – where workers generally have greater technical

expertise – low-skill parts of manufacturing such as these have

become less important. Of course, as countries develop further,

they begin to move up the value chain; China is perhaps the

best example, having become an important producer of motor

vehicles and with aspirations to move into aerospace.

25 years of change – and the UK slips

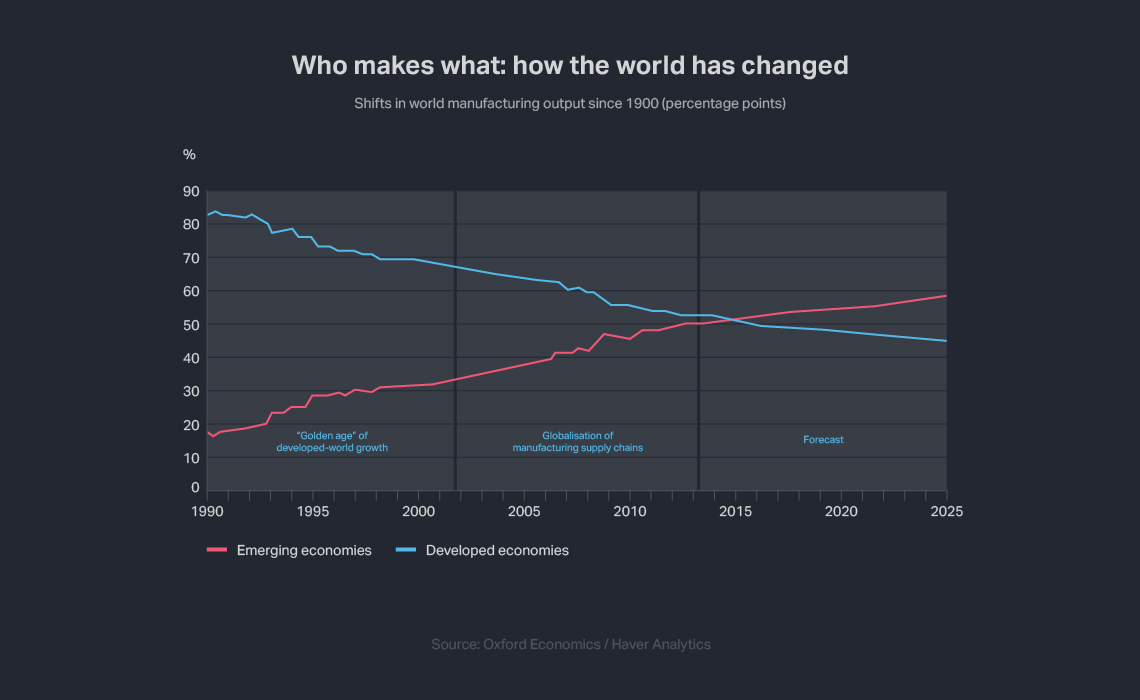

The past quarter century can be divided into two periods.

During the 1990s, the developed world enjoyed the strongest and

longest economic expansion for decades. By the middle of the

decade annual growth in the US’s total output was well above 4

per cent, while in Western Europe it was almost 3 per cent.

While global trade was strong, manufacturing supply

chains were still largely regional, with most activity

occurring within the developed world. So even though the

developed world’s share of global manufacturing slipped during

this period, it remained at a commanding 70 per cent by the end

of the decade.

This changed dramatically upon the accession of China into the

World Trade Organisation at the end of 2001. Since then, its

share of global manufacturing has more than doubled from 9 per

cent to 23 per cent and it has become a central player across a

broad spectrum of sectors. This has had ripple effects across

other South-East Asian countries such as Indonesia, Thailand

and Vietnam. As a result, emerging economies became more fully

integrated into manufacturing value chains. This has

essentially equalised the global manufacturing share of the

developed and emerging world.

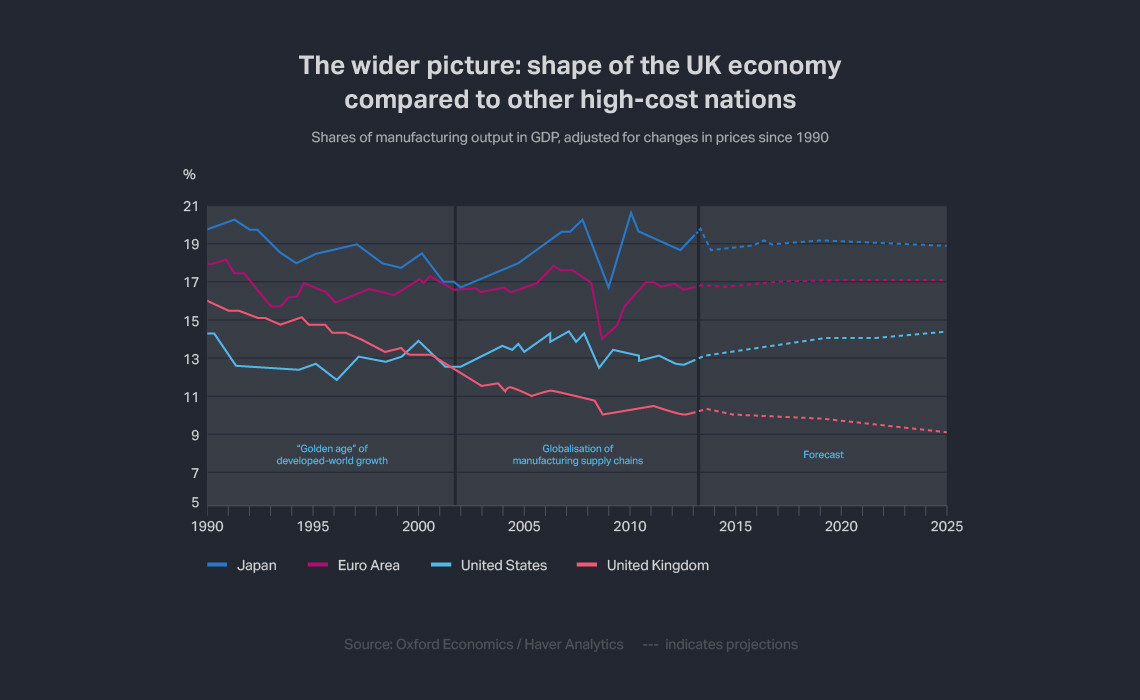

There are contrasts within the developed world in terms of the

evolution of the manufacturing footprint over the past 25

years. Perhaps the most surprising observation is that,

allowing for ups and downs related to the business cycle, in

inflation-adjusted terms manufacturing has been remarkably

stable across many countries. This provides welcome evidence

that the secular decline in the manufacturing footprint has

ended, and confirms that the declining share of world

production is more a function of slow overall economic growth

relative to the emerging world rather than a “disappearance” of

manufacturing activity.

The UK is a notable exception to this rule. Manufacturing’s

share of gross domestic product has continued to shrink. At

about 10 per cent the proportion is among the lowest figures

for this ratio in the developed world. Underlying this is the

fact that UK manufacturing has not made gains in labour

productivity in the same way as other developed countries.

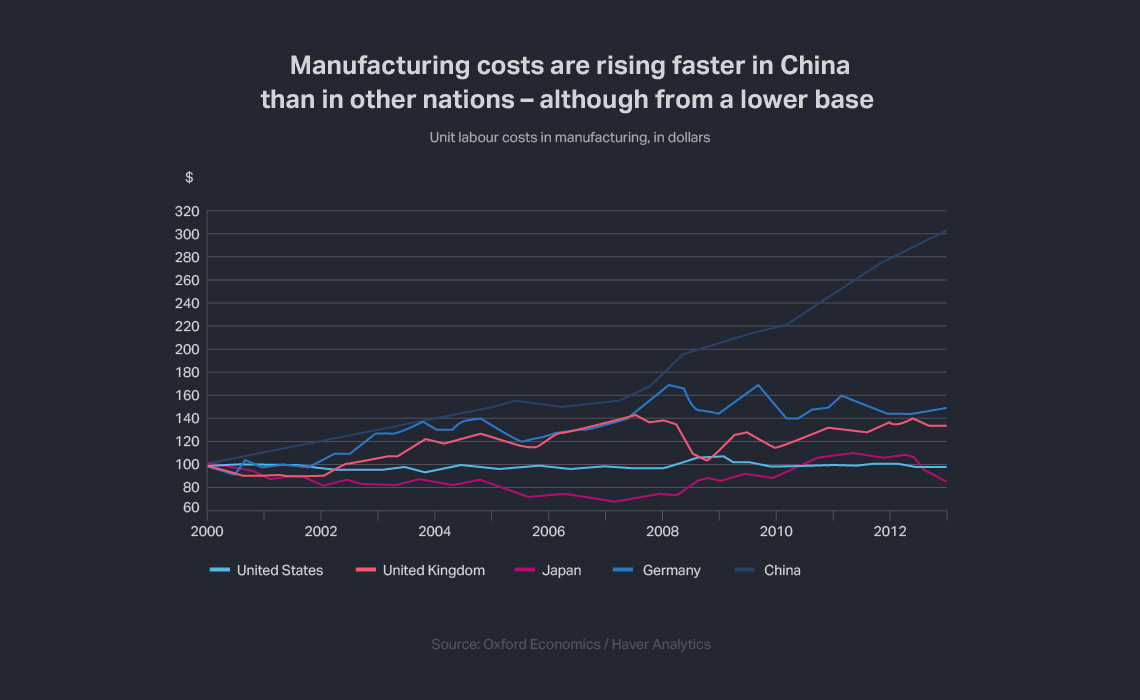

From 2000 to 2010, labour productivity improved by 40 per

cent in UK manufacturing, compared to 70 per cent in the US.

Productivity gains are especially important to industrial

competitiveness in the developed world – where unit labour

costs are already likely to be higher than in emerging markets.

It follows that if manufacturers in such nations can make

themselves more productive, their commercial performance will

be better – which will keep the overall level of manufacturing

in the economy fairly high. This is what has happened in Japan

and Germany, where industrial productivity has been ahead of

Britain’s, and the proportion of manufacturing in output has

not fallen as fast.

A second reason for a falling UK share is higher power prices

than in other parts of the developed world. Unsurprisingly,

this has hit power-intensive sectors such as steel and basic

chemicals particularly hard. It has had an impact – albeit not

so severe – in other parts of manufacturing which also are

relatively heavy users of energy. In contrast, the US did not

ratify the Kyoto protocol affecting regulations over carbon

dioxide emissions. This means it has avoided implementing

measures to reduce carbon dioxide emissions that have in other

countries pushed up energy prices. Moreover, the recent shale

oil and shale gas boom has driven US energy prices even lower,

providing support to energy-intensive industries there.

The UK should do well in an improved climate – but still needs

to raise its game

Looking ahead, the developed world’s share of global

manufacturing output is likely to continue to decline, though

at a slower pace than in the past quarter century. This

reflects the fact that the significant structural change in

global manufacturing supply chains that began in earnest in the

early 2000s has largely played itself out. China’s

manufacturing footprint (as a proportion of the country’s total

output) has stabilised and may in fact decline slightly as the

government attempts to rebalance economic growth towards

consumption and away from investment. Developed countries

continue to have considerable competitive advantages in

high-end manufactured products, demand for which is increasing

in the emerging world.

Manufacturing is far from

disappearing in the developed nations, even though growth

prospects in other parts of the world are stronger.

The performance of individual economies within the developed

world will vary. In new forecasts by Oxford Economics and Haver

Analytics, the US stands out as having a positive manufacturing

future. Benefiting from a confluence of low energy prices,

further productivity gains and favourable demographics, US

manufacturing is stronger than it has been in a decade. The

small increase likely in the footprint of manufacturing within

the US economy is expected over the next decade to keep the

US’s share of world manufacturing output steady at roughly 18

per cent of the total.

Most other industrialised countries are expected to see their

share of global manufacturing continue to fall, particularly

Japan and Germany. (The figures for these projections are

calculated on an inflation adjusted basis with output numbers

pegged to 2010 dollars.) Each of them is expected to lose a

further 1-2 percentage points of share by 2025, driven in part

by energy cost pressures, but accentuated by slow growth in

domestic markets due to stagnant or falling populations.

British manufacturing on the other hand is projected to be

fairly resilient. While it currently has the lowest share of

global manufacturing among the major developed countries

(having fallen behind France during the 1990s) it is not

expected to fall much further. From accounting for 2.1

per cent of world manufacturing output now, the country’s share

will decline by 2025 – but by less than 0.5 percentage point,

to 1.7 per cent. In comparison with the declines of the past

three decades, this is fairly minor.

Helping this trend is the UK’s strength in two key parts of

manufacturing – cars and aerospace. Since the financial crisis,

Britain has become an important platform for automotive

production destined for continental Europe, with companies such

as Germany’s BMW stepping up investments in their UK plants.

Other makers of luxury cars such as Jaguar Land Rover and

Bentley have seen higher demand for their vehicles in new

markets in Asia led by China. Furthermore, the UK has a key

role in aerospace supply chains, which is projected to be one

of the fastest-growing sectors for the next decade.

However there remain areas of concern in other sectors such as

chemicals and fabricated metal products that are expected to be

adversely affected by relatively high energy prices. An

important conclusion is that Britain needs to address its

problems in productivity – which may be rooted in relatively

low investment in high-tech machinery as well as a poorly

trained workforce hit by a shortage of top end engineering

skills – if it is to make the most of what could be a promising

period for rich-world manufacturing in the coming decade.

A version of this article

will be published as an Oxford Economics research note.