Bluetree - run by Adam Carnell (left) and James Kinsella - has seized the opportunity to make large amounts of high-grade hospital masks in its UK factory

Boost for UK makers of protective wear as fears grow of new Covid wave

Other stories you may be interested in

A company run by two 34-year-olds in a former coal mining town in South Yorkshire has become an unlikely success story from the pandemic. After investing £18m in machines and research in the past two years, Bluetree has grown into one of the UK's biggest makers of personal protective equipment (PPE), a sector that shot to prominence during the health crisis.

Manufacturers such as Bluetree have been buoyed by government plans to ensure half the PPE used by health and care staff is made in the UK, against just 1 per cent before the pandemic. Supply of PPE to frontline health workers has become a hot topic, especially due to indications that National Health Service workers could be hit by a new wave of Covid cases this winter as infections, hospital admissions and deaths have risen.

How the government initiative works out will be a test of prime minister Boris Johnson's interest in supporting UK manufacturing, especially since he encouraged more “onshoring” after Brexit. “The UK is capable of manufacturing [PPE] at a competitive price, and the products will be at the front of the development curve,” said James Kinsella, Bluetree's joint chief executive, who runs the company with his colleague Adam Carnell. “We have the expertise and the capabilities in the UK to bring PPE into the 21st century.”

Bluetree – whose PPE expertise centres on high-grade facemasks – is among a swathe of manufacturers that have invested in this area of production in the UK, creating more than 1,000 jobs.

Environmental benefits are an important potential advantage of boosting local production. Sourcing from the UK would cut down on transportation of items that are often shipped over large distances, from countries such as China. There are also hopes that UK-based manufacturers could develop more reusable PPE to reduce reliance on disposable PPE, which dominates today.

But the government has revealed few details of its "buy British" ideas and sceptics question the idea, especially given the record of the Department of Health and Social Care and other agencies in managing PPE procurement so far.

Official plans call for at least 50 per cent of protective health equipment used in the UK to be made in domestic plants - but the government has declined to provide details

Official plans call for at least 50 per cent of protective health equipment used in the UK to be made in domestic plants - but the government has declined to provide details

PPE is the term for items such as facemasks, gowns, aprons and eye protectors used by health workers to shield them from viral infection. Formerly a manufacturing backwater, PPE is now regarded as a strategic industry: in the first year of the pandemic, the UK government spent a massive £15bn buying PPE. Most orders went to overseas manufacturers.

Shortages of these items in the early stages of the crisis were widely blamed for the UK’s heavy initial death toll – which now stands at more than 142,000, the highest in Europe excluding Russia, and the eighth highest in the world. Arguments were raised early on that the UK's huge reliance on other countries for PPE placed it at a big disadvantage at a time when the world was scrambling for supply.

The potential requirement for PPE in the next few years is indicated by data showing the intensity of usage in hospitals and other NHS settings – PPE demand divided by hospital Covid patients – quadrupled in the six months to the end of September compared to the previous six months. The rise appears to be linked to greater rigour in hospitals on infection control and suggests demand will stay high to combat coronavirus and other viral threats, despite more people having vaccinations.

News of the government's intentions over PPE manufacturing came in comments in June by Sir Chris Wormald, permanent secretary at the DHSC. Speaking to the House of Commons' public accounts committee, Wormald said: “Going forward, we now have plans for more than half of our PPE to be produced onshore [in Britain]. That is being worked on right now…this is a work in progress to develop our future resilience.”

The department declined to elaborate. It said: “We are working through a future PPE strategy, which will carefully consider how the department and NHS Supply Chain can build on the significant positive changes made to the supply and distribution of PPE during …the pandemic. As part of our strategy, we will set out the future role of UK manufacturing in the PPE supply chain.”

A series of UK and overseas-based manufacturers have invested in making protective equipment in the UK, creating more than 1,000 jobs

A series of UK and overseas-based manufacturers have invested in making protective equipment in the UK, creating more than 1,000 jobs

Ben Fletcher, chief operating officer at the manufacturing trade body MakeUK, would like the government to clarify its intentions. “We'd like to see the government change its model for PPE procurement to one that [considers] environmental and social costs as well as price, and as a result encourages more UK-based manufacturing. This would have to go beyond an expression of intent and be based on awarding long-term contracts to recognised UK-based suppliers.”

Tony Bellis, head of government affairs at the UK arm of US industrial group 3M, said ministers should “find a balance between giving long-term contracts to UK based companies [for PPE manufacturing] … and allowing trusted suppliers to curate their own [overseas-based] supply chains”.

A mix of UK and foreign businesses have set up or expanded plants in the UK to make PPE. Among the latter is Canada's Medicom, which operates plants around the world including a new factory in Northampton making 1.5m hospital masks a day and employing 250 people.

The company has set out long-term ambitions for Britain, based on a plant that it says could be expanded considerably. "[We have] the potential to become a significant player in the supply of [health] protection products to the UK market," said Hugues Bourgeois, managing director of Medicom's UK arm.

Kenton Robbins, managing director of PFF, a West Yorkshire-based business that has moved into PPE, sees plenty of opportunities. “In the past … procurement decisions [on PPE] have been based on value – buying at the lowest price – rather than sustainability and the need to ensure the UK has a supply route that is resilient and reliable. I would like to explore whether we can play a part in putting PPE supply in the UK on a different basis.”

While Bluetree, Medicom and PFF have gained significant government PPE contracts, other companies are less happy, complaining that their efforts to bid for orders have been ignored or pushed aside.

Gamze Guney, managing director of Global Health and Safety, a UK-based PPE supplier, has voiced “great disappointment” over her company's failure to win government mask contracts, despite setting up manufacturing in Harlow, Essex.

Medicom - a big Canadian healthcare business - has started its first British plant in Northampton to make hospital masks

Medicom - a big Canadian healthcare business - has started its first British plant in Northampton to make hospital masks

Guney said she spent months trying to start contract discussions with the DHSC, going so far as to directly lobby Johnson and the former health secretary Matt Hancock. Ultimately, she said, she felt “abandoned” by the government.

Simon Loose, managing director of Rocialle Healthcare, a maker of health equipment based near Aberdare, south Wales, has been left similarly frustrated in efforts to gain high-volume PPE orders. “I was encouraged by the government narrative around local supply resilience, but I have seen little evidence so far that the UK government intends to change the basis for its procurement policies to put more of an emphasis on local UK manufacturing by established local businesses.”

Other concerns have also emerged from the government's sometimes flawed approach to handling the Covid crisis. After an earlier inquiry into PPE, the public accounts committee said in February 2021 that the government’s rush to buy PPE early in 2020 opened “increased risks of unequal treatment of suppliers and poor procurement processes”. As a result the DHSC “wasted hundreds of millions of pounds on PPE which is of poor quality and cannot be used for the intended purpose”.

Doubts about the likely success of the plan to boost domestic PPE orders have also resulted from worries about pricing, even allowing for the potential of greater automation to cut production costs. Historically PPE from British factories has cost much more than comparable goods manufactured in low-wage nations including China, the leading country for PPE production.

During a period when government spending is likely to come under renewed pressure as ministers try to steer the economy through the recovery, the potentially higher costs of "buying British" could derail some of the thinking sketched out by Wormald in June. In his comments Wormald acknowledged the possibility of tensions between establishing a greater security of PPE supply through more domestic orders, and potentially having to pay more for it.

“There will be some circumstances where we have some choices between absolute price and wider value for money via resilience... Of course we want both of those things—we want good price and we want resilience,” Wormald said.

Luella Trickett, a health equipment expert at the Association of British HealthTech Industries, a trade body, also points to the potential challenges. “How this [desire to buy from British factories] is balanced with future demand for PPE and cost pressures on the NHS, with good supply of some types of PPE already held by the government, remains to be seen,” she said.

Tussle for contracts separates winners and losers

London-based Fashion Enter spent £100,000 making a new range of reusable hospital gowns but in its bid to win high-volume contracts has "hit a brick wall"

London-based Fashion Enter spent £100,000 making a new range of reusable hospital gowns but in its bid to win high-volume contracts has "hit a brick wall"

Two distinct groups have emerged among the companies that have started or expanded production of personal protection equipment (PPE) in the UK. In the first camp are those that have won sometimes big government PPE orders.

The second includes those whose efforts to secure contracts have been unsuccessful, leaving them feeling aggrieved at the outcome.

In the winners’ camp is Manchester-based Globus. It has spent “tens of millions of pounds” on new plants in Warrington, north-east England, and Dumfries in Scotland, creating 600 jobs and building capacity to make 1.3bn hospital masks of different types per year.

The company won a £53m mask contract with the Scottish arm of the National Health Service and gained other orders from the DHSC in England. “We went through the [procurement] process set out by the government which was comprehensive and efficient,” a Globus spokesperson said.

Fashion Enter is in the unsuccessful group. The London clothing manufacturer has spent about £100,000 of its own money on design, manufacturing and testing of reusable hospital gowns. After agreeing a contract with a London health trust to make 10,000 of the gowns for trials, the company spent almost a year trying to interest officials at the DHSC and Cabinet Office in bigger orders, involving possibly other manufacturers that would join in a bigger project using Fashion Enter's designs.

However the company has now ended its involvement with reusable gowns, in favour of concentrating on its main business line of women's clothing. Caroline Ash, a Fashion Enter director, said: "We have tried so many avenues to make this work. We gained very little help [from government departments]. Everywhere we looked, we hit a brick wall."

Most of the orders handed out by the government so far in the pandemic have benefited non-UK manufacturers. In the early stages of the crisis, the UK authorities were often forced to overpay considerably, due to the huge spike in global demand for PPE triggered by the onset of Covid.

If the government succeeds in its plan to boost UK PPE manufacturing, more domestic production could in theory make it easier for the NHS to gain access to the supplies it needs.

Most of the companies setting up or expanding PPE plants in the UK have done so in less wealthy regions, increasing job opportunities in these areas and supporting some of the thinking behind prime minister Boris Johnson's – so far nebulous – “levelling up" strategy.

Among the non-UK businesses that have installed additional production capacity (sometimes starting new plants) in the UK is Berry Global, which makes packaging and speciality materials. The US company has started a production line in Aberdare, South Wales, to make meltblown, a high-value polypropylene-based material that is a key component of hospital-grade facemasks. Until recently, the UK had virtually no plants making the chemical, the biggest producers of which are in Germany and China.

Medicom of Canada won a £308m contract in 2020 to supply hospital facemasks to the DHSC, setting up its first UK plant – in Northampton – as a result. Hugues Bourgeois, managing director of the company’s UK operations, said: “I’ve been impressed by the quality of the employees we have taken on [in Britain] and their level of engagement. The British government representatives we have meet have been professional and capable. I feel we have a solid basis for collaboration.”

German manufacturer Dräger – which has run factories in the UK for some time – started a new plant in Gateshead, northeast England, to make face masks, in a contract worth about £80m.

Many of these companies say they have invested large sums in automation, cutting the labour content in the manufacturing of goods such as PPE and narrowing any cost disadvantage linked to basing production in Britain.

Bluetree – a UK-owned business based in Wath Upon Dearne near Rotherham – has moved into hospital-grade facemasks as a diversification from its mainstream business of printing. Masks – made using automated machinery mainly bought from overseas but which the company says it wants to supplement with UK-made equipment – account for 240 out of its workforce of 600. Bluetree has also set up a plant to make meltblown as a raw material for its own mask production and to sell to other businesses.

Almost all those on the health side of the company have been recruited in the past two years. In 2020 the company gained a £64m DHSC contract to make about 350m hospital masks.

“A well invested UK business can produce a product to a comparable cost to [East Asia] production,” said James Kinsella, joint Bluetree chief executive. He says there is “huge demand” for developing new products that serve the needs of users better and he feels big opportunities exist in this area for his company and others.

As an example, Bluetree is developing a new range of transparent masks for intended sale in 2022, that it says will allow better communication and be less off-putting for people in healthcare settings. It has been working on such masks with health staff at the Alder Hey children's hospital in Liverpool.

Suchin Talwar, managing director of Southampton-based Polystar, which won a £26m government contact in 2020 to make polyethylene hospital aprons, is optimistic about gaining new orders. “If the government buys PPE from UK producers it has greater security of supply, while the country benefits from a boost to employment, increased business to transport companies and greater revenues from corporation and income tax.”

Also upbeat is Tarkan Conger, business development director at British Rototherm, a company in Port Talbot, south Wales, that has won government PPE contracts, expanding employment as a result. “Our experience of dealing with government officials has been fantastic,” Conger said.

Against such positive reports are the views of companies that feel they have been badly served by the government and have missed out on large contracts. Among these businesses are three that during the pandemic gained government innovation grants to develop novel PPE – but then made little headway in gaining procurement orders.

While the businesses say they never expected winning government contracts would be easy they feel they could have gained more assistance from officials at InnovateUK – the agency dispensing the grants – to open lines of communication over purchasing with other parts of the government.

In the early stages of the pandemic, P&P Clothing, a Mansfield garment maker, was awarded a £75,000 grant from InnovateUK to develop protective wear for hospital workers[web link-see end of story] that could be re-used through washing. Nearly all current forms of PPE are discarded after one use, adding greatly to the UK waste mountain. The reusability of the products came partly from the items using a high-grade polyester material made by the UK arm of Japanese textile producer Toray, whose factory is also in Mansfield.

The Yorkshire company Bluetree has moved into making protective masks for heath workers and has added 240 jobs

The Yorkshire company Bluetree has moved into making protective masks for heath workers and has added 240 jobs

Paul Ingham, P&P's managing director, said: “We had great support [on technical aspects] from InnovateUK. We received a lot of positive feedback from [local] health trusts.

“But we have been frustrated by our inability to get a proper hearing [on potential procurement deals] with parts of the government including the Department of Health and Social Care and the NHS. We've been searching for a key to a door – and can't find it.”

Worksafe Design, based near London, is another company making an innovative form of PPE that feels it has had a poor official response on high-volume orders. It gained a £50,000 InnovateUK grant to help develop a new form of lightweight personal respirator to protect health staff from viral particles. The company puts its total spending on developing the product at about £200,000.

Mike Bradley, Worksafe Design's founder and director, said he had assumed InnovateUK would have contacts in other parts of the government that could hand out contracts. Ideas that emerged during the development could be handed on to departments such as the DHSC that could learn from them, possibly using them as a basis for contract negotiations.

Bradley said: “It was great to get the development money. But we had expected more help from InnovateUK over ways to use the grant as a basis for large-scale procurement involving other government departments.

“We had the sense the agency felt it had given us the money, and then we were on our own. The feeling we were left with is that the [procurement arm of the DHSC] operates in a bubble divorced from the real world and which it has been impossible to penetrate.”

PPECO, based in Preston makes biodegradable face visors for coronavirus protection. It was helped by a £71,000 InnovateUK grant to assist in the development of the ideas behind its cellulose-based product.

Richard Taylor, chief executive and founder, said he was very pleased to get the grant. After this the company formed connections with three organisations that have assisted with the product's development, including the National Physical Laboratory, a government agency that advised on steering the product through regulatory reviews; the University of Central Lancashire, which assisted on medical standards; and Lancaster University which undertook life-cycle analysis.

Richard Taylor of PPECO -pictured with one of his company's biodegradable face visors - has tried hard to win government contracts

Richard Taylor of PPECO -pictured with one of his company's biodegradable face visors - has tried hard to win government contracts

But Taylor has been disappointed by lack of success in using InnovateUK connections to create a pathway towards opening talks with government procurement agencies. "I thought we succeeded with our product development and after this had a good basis for discussions with other government departments about winning orders. In terms of how InnovateUK connects with other parts of the government on procurement, I feel there is room for improvement."

Kenton Robbins, managing director of PFF, a company based near Leeds that won a £18.4m DHSC contract in 2020 to make hospital aprons, said: “I can understand the frustration of UK companies that have worked hard to put themselves in a good position to supply PPE from British plants and now find they cannot win orders…. Whilst not everything the DHSC has undertaken has been perfect, [most officials] have shown exemplary levels of commitment and tenacity in challenging and uncertain times.”

InnovateUK declined to discuss its dealings with the three businesses, nor its connections with other government departments. It said: "We are confident that we have supported [the three companies] throughout their journey with us."

The DHSC said it did not want to talk about interactions with specific with companies. It advised businesses that wanted to bid for government contracts to follow the advice on official websites.

PPE use climbs above government assumptions

Use of protective equipment in hospitals during the pandemic has soared above official projections, stoking demand for more UK production

Use of protective equipment in hospitals during the pandemic has soared above official projections, stoking demand for more UK production

Since the start of the crisis, personal protective equipment (PPE) has been used in enormous quantities. Between February 2020 and September 30, 2020, the Department of Health and Social Care has bought and distributed more than 14bn individual pieces of PPE – most of which is used once and then discarded, creating huge waste. It says it ordered 32bn items.

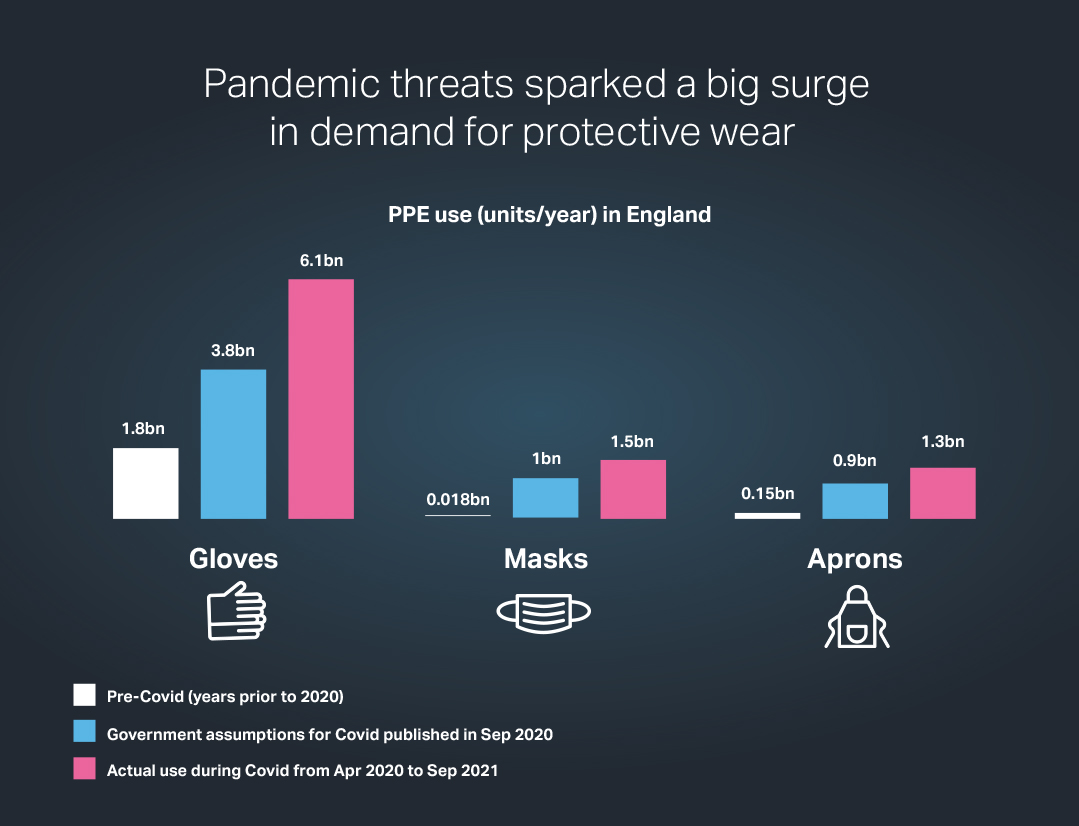

The volumes required show huge rises on the figures used before the pandemic, and in most cases are far more than demand estimates published in a DHSC strategy paper in September 2020 (see below).

Source for all Charts : DHSC experimental statistics for PPE distribution in England; Government coronavirus daily updates; DHSC PPE strategy paper Sept 2020

Source for all Charts : DHSC experimental statistics for PPE distribution in England; Government coronavirus daily updates; DHSC PPE strategy paper Sept 2020

For instance, use of hospital isolation gowns in National Health Service centres in England was running at about 750,000 units a year before the pandemic. The strategy paper assumes that about 18m isolation gowns would be needed for a full year of Covid. In the event, about 41m were required.

In the case of hospital masks of all grades, only about 18m were needed each year before coronavirus. The strategy paper suggested annual demand during the pandemic more than 50 times greater, at 1bn masks. However, during the first year of Covid, some 1.5bn masks were needed.

PPE as counted in official statistics covers a variety of items including body bags, hygiene products and swabs. However, some 93 per cent of the more-than 14bn items of PPE used in the crisis fall into five categories: Type IIR and FFP3 masks, aprons, gowns and gloves. Of these, due to recent manufacturing investments, all but gloves are being made in high volumes in the UK.

How demand for shielding equipment surged as the crisis unfolded

Use of protective equipment in the heath service has stayed extremely high, even as the pandemic's impact has declined since its worst stages

Use of protective equipment in the heath service has stayed extremely high, even as the pandemic's impact has declined since its worst stages

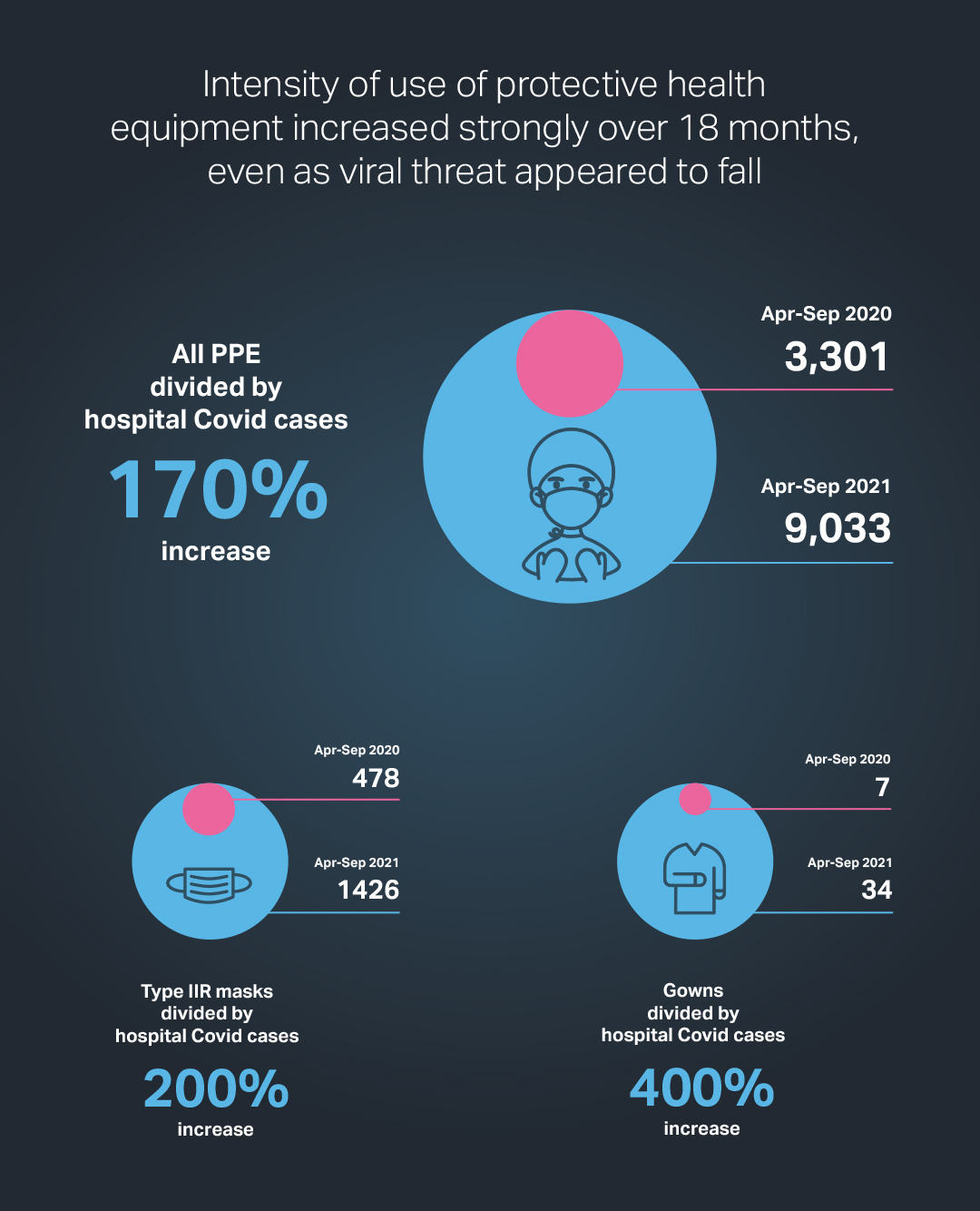

Data compiled by Made Here Now show that the intensity of use of personal protective equipment (PPE) – the total amount required, adjusted for the perceived severity of the pandemic as indicated by hospital Covid cases – has risen markedly since the early stages of the crisis.

As a result, even though the numbers hospitalised are significantly lower than at the peak of the crisis in January 2021, demand for PPE has remained high, indicating greatly increased awareness of infection risks, especially amid signs that the threat from coronavirus may be worsening.

The rise in the “PPE intensity ratio” – a measure devised by Made Here Now - underlines how access to protective equipment has become increasingly important as the Covid era has stretched out. On the assumption this continues, greater availability of domestically produced PPE could reduce fears over security of supply.

The potential for demand to increase significantly has prompted at least one manufacturer to invest in UK-based PPE production. James Kinsella, co-chief executive of South Yorkshire-based Bluetree, said the company’s decision to start a face mask plant was related to projections of how the pandemic would evolve, especially related to NHS policies on shielding health workers from viral spread.

"We envisage a greater accent in hospitals on infection control to cut down not just on Covid but other diseases such as flu. This will require more PPE including masks," Kinsella said.

In recent weeks, government figures related to the severity of the crisis have risen alarmingly. On November 2, daily registered Covid deaths in England reached 255, the highest since early March. For nearly all of June, there were fewer than 20 deaths from Covid a day.

Daily hospital Covid cases in England have climbed from below 1,000 in May and June this year to more than 7,000 in early November, similar to the numbers in October 2020, after which cases climbed precipitously to a peak of more than 34,000 on January 18. Two days later, 1,662 deaths were recorded, the highest number for England so far.

Any repeat of this over the next few months would, while signalling a catastrophe for the health system, hugely increase demand for PPE.

Made Here Now data based on the "intensity ratio" have revealed key trends shaping demand for items such as masks and gowns, pointing to a tightening of efforts to control infection in hospitals and other health settings

Made Here Now data based on the "intensity ratio" have revealed key trends shaping demand for items such as masks and gowns, pointing to a tightening of efforts to control infection in hospitals and other health settings

Behind the Made Here Now data is an analysis of the intensity ratio over the three six-month periods since around the start of the pandemic in April 2020 and for which government figures are available.

The intensity ratio is the number of items of equipment distributed to National Health Service establishments including hospitals, divided by the sum over a set period of the daily figures for Covid hospitalisations. The latter measure is the best simple indicator of the seriousness of the threat to health workers from coronavirus.

The ratio for the most recent period – April to September 2020 – was four times greater than during the second period covered by the analysis over the previous six months. Between the first and third periods, the ratio went up by a factor of 2.7.

In the most recent six months, the sum of the daily figures for hospital cases came in at fewer than 600,000, much less than the 2.7m total hospital cases in the previous six months at around the peak of pandemic so far.

Despite this indication of a reduced threat, 5.1bn PPE items were used in the latest period, only slightly below the 6bn in the previous six months. As a result of these changes, the intensity ratio between these time spans rose sharply to 9,033, from just 2,230.

In the first six months of the analysis, the 3.2bn PPE items were recorded as being used, for a total of 980,000 hospital cases, giving an intensity ratio of 3,301. The data for this period must be treated cautiously since equipment use is likely to have been constrained by lack of supply, linked to low government stocks.

By the start of the second period, in October last year, massive government ordering led to supply no longer being an issue. As a result, the amount of PPE being used was more likely to provide an accurate assessment of what health workers thought was necessary to fight the disease.

The rise in the ratio between the second and third six-month periods for some specific items of PPE was also high. The ratio for isolation gowns more than doubled while the comparable number for Type IIR masks – the most widely used type of hospital face mask - went up four times. The chart below shows changes in the intensity ratio between the first and third six-month periods.

The intensity ratio is based on PPE use by the NHS for England only. Detailed data for PPE use in other parts of the UK are less easily available. Numbers of hospital cases are also based on data covering only England. Roughly 70 per cent of PPE purchased for the NHS is used in hospitals with the rest going to other places such as care homes and doctors' surgeries.

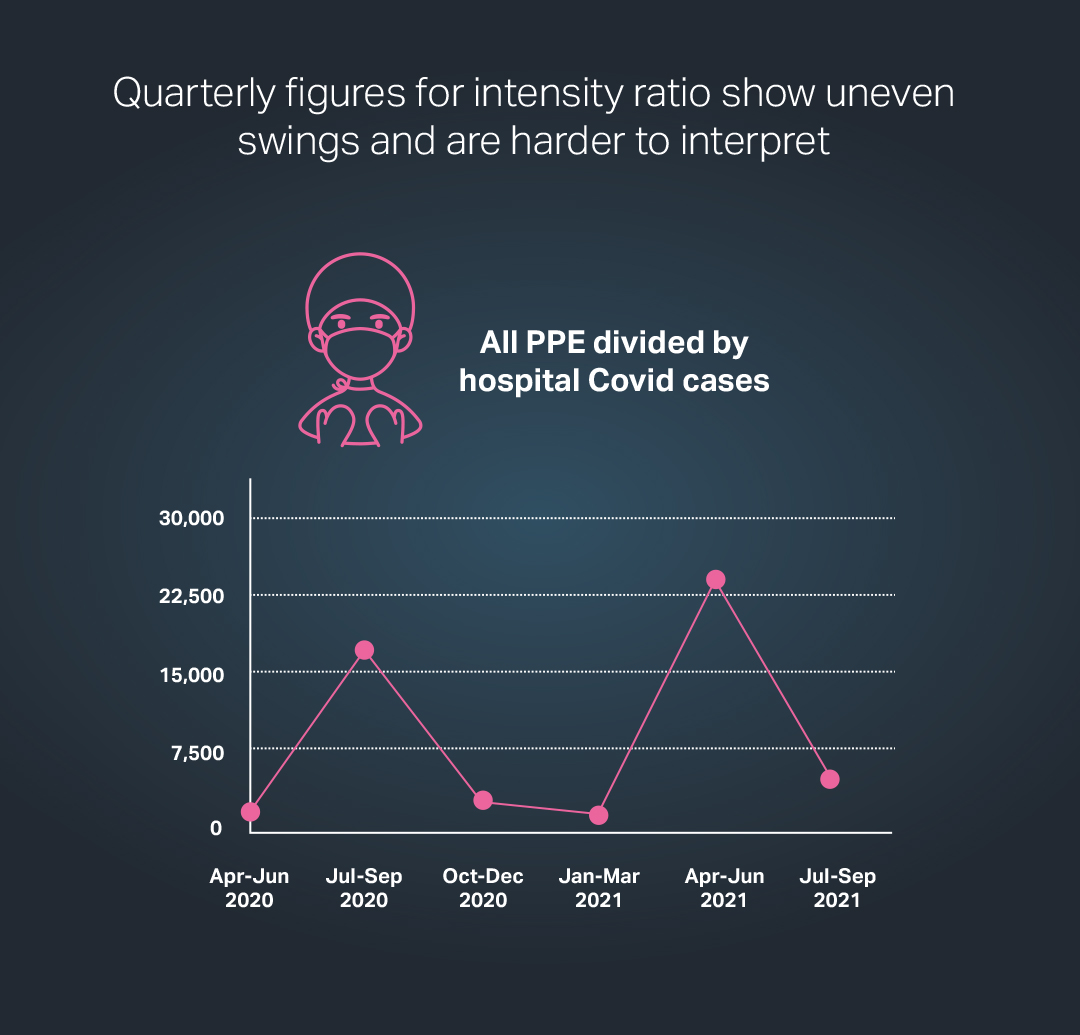

An interpretation of the data for the time between April 2020 and September 2020 that is based on six quarterly periods – rather than three spans of six months – provides a more nuanced view of shifts in PPE demand relative to hospital cases (see below).

Source for all Charts : DHSC experimental statistics for PPE distribution in England; Government coronavirus daily updates; DHSC PPE strategy paper Sept 2020

Source for all Charts : DHSC experimental statistics for PPE distribution in England; Government coronavirus daily updates; DHSC PPE strategy paper Sept 2020

Under this method of analysis, the intensity ratio for the most recent three months – from July to September 2020 – comes in at 5,155, appreciably less than the figure of more than 23,000 registered for the quarter immediately before this when hospital cases were very high.

However the ratio for the most recent three months – when hospital cases have been quite low – was still markedly above the equivalent numbers for all but two of the other five quarters covering the pandemic.