Inside Yamazaki Mazak’s machine tool factory in Worcester: Brexit has introduced “more complex and bureaucratic procedures” and failed to produce benefits, the company says

European retreat has harmed UK industrial future, says Made Here Now poll

Brexit has badly damaged the prospects for UK manufacturing, according to a Made Here Now survey in which two-thirds of respondents said leaving the European Union had hurt their business. Just 6 per cent said the impact had been positive.

The overwhelmingly negative view among manufacturers adds weight to several government and academic reports indicating that the change has weakened the UK economy and made businesses less competitive. The new poll asked 54 companies, covering most manufacturing sectors and spread around the UK, about their post-Brexit experience. The responses were dominated by private businesses, with quoted firms generally declining to respond.

Many pointed to difficulties created by the UK’s departure from the zero-tariff European Single Market, arguing that new rules on trading and product regulation had increased bureaucracy and costs.

William Cook makes high-tech steel castings in its Sheffield plant - its chairman says the EU exit has led to “border delays and recruitment difficulties”

William Cook makes high-tech steel castings in its Sheffield plant - its chairman says the EU exit has led to “border delays and recruitment difficulties”

Others said the end of free movement between the UK and EU countries had reduced their ability to recruit or retain employees from EU countries, weaking the workforce and exacerbating labour shortages. On top of Covid and the war In Ukraine, the impact of Brexit has had a chilling impact on the economic outlook, the majority believe.

Just over a quarter of the respondents were neutral on the impact of Brexit, saying either that it had made little difference or that the positives and negatives cancelled each other out. Together with the small minority saying the change had been positive, the number of “neutrals” could lend weight to the pro-Brexit suggestion that leaving the EU might result in new business opportunities further afield or trigger more “reshoring” of production in the UK.

Robert Etttinger, chairman of leather goods maker Etttinger, describes Brexit’s impact on supply chains as “not much short of a disaster”

Robert Etttinger, chairman of leather goods maker Etttinger, describes Brexit’s impact on supply chains as “not much short of a disaster”

Strongly against this view, however, is Robert Ettinger, chairman of Ettinger, a maker of leather fashion goods with a factory in Walsall. “Because of Brexit, my company’s supply chains are not much short of a disaster,” he says. “I cannot see any positives”.

Ted Varley, managing director of Cogent, a Leeds engineering business, described Brexit as a “shitshow”, adding: “Supply chain management is a nightmare, [we are] having to hold a large amount of stock as we can’t rely on deliveries.”

Fashioning leather wallets and other leather goods in a factory in Walsall is the basis of a global businesses for family-owned manufacturer Ettinger

Fashioning leather wallets and other leather goods in a factory in Walsall is the basis of a global businesses for family-owned manufacturer Ettinger

Several companies that trade heavily with Continental Europe expressed special concerns about how Brexit had made business conditions more challenging.The EU is the UK’s biggest trading partner, in 2020 accounting for 42 per cent of exports and 50 per cent of imports.

Sir Andrew Cook, chairman of William Cook, a Sheffield-based maker of castings for sectors such as oil and gas, said Brexit had “caused significant administration-related border delays and recruiting difficulties”. He added: “The European Single Market was exactly that – a single trading zone with no internal frontiers…. These features allowed this company to buy materials and sell finished products within the single market with as much ease as if it was within Yorkshire, and easily recruit the skilled labour we need from wherever in the EU it was available. This is no longer the case.”

Fired up: steel castings maker William Cook is among a large number of manufacturers exercised by what they see as the negative effects of Brexit

Fired up: steel castings maker William Cook is among a large number of manufacturers exercised by what they see as the negative effects of Brexit

The UK division of Yamazaki Mazak, a large Japanese machine tool maker with a factory in Worcester, sells 85 per cent of its output to the EU. Marcus Burton, Yamazaki’s former UK chief executive who is now an adviser, said that to manage logistics it has had to “increase the number of administrative staff for import and export and our external costs have increased significantly… We have introduced more complex and bureaucratic procedures to confirm compliance with rules of origin”. The company has been “unable to identify any opportunities or benefits from Brexit”, Burton said.

The UK formally left the EU in January 2020, following the country’s narrow vote in June 2016 to quit the Europe-wide trading and political bloc, reducing its membership to 27 nations. At the end of 2020, a transition period ended and the UK left the Europe Single Market and its associated customs union, ushering in new trade rules.

Even given the dominant majority view, not everyone in the poll voiced a negative opinion of how Brexit has played out. Christopher Nieper, chairman of David Nieper, which makes women’s clothing, was one of the three people in the survey who said the change had been positive for his business.

“It’s been a catalyst for us onshoring the bulk of our supply chain… which has brought many other strategic benefits,” Nieper said. “The fear about EU staff recruitment is mis-placed. By far our best staff are locals, including supervisory and managerial – over half of our staff have been with the company for over 10 years. Recruiting from outside the country may bring instant skills but it doesn’t necessarily bring long-lasting skills and it doesn’t necessarily bring a cultural fit which is so important in manufacturing.”

Christopher Nieper, who runs Midlands clothing maker David Nieper, is among a small number of manufacturers who say the UK’s EU departure has led to benefits - including an increased incentive for the country to train skilled workers

Christopher Nieper, who runs Midlands clothing maker David Nieper, is among a small number of manufacturers who say the UK’s EU departure has led to benefits - including an increased incentive for the country to train skilled workers

Craig Wright, chairman of Wright Industries, a Birmingham business making specialised electronic parts, also answered “positive” on the EU departure. “Europe used the UK as a huge financial sink, now we are not there to prop it up, watch the demise, we can redeploy our resources to UK global enterprise now…Since Brexit [my company has] attracted more government and external investment and seen the opportunities skyrocket.”

One factor cited as positive by some Brexit supporters has been the slide in the value of the pound since the 2016 referendum which has helped some exporters price their goods more favourably in overseas markets, though it has also pushed up costs of imported materials and machinery. Since June 1 2016, sterling’s trade-weighted value against a basket of key currencies as measured by the Bank of England has fallen 12 per cent.

While manufacturing accounts for only about 10 per cent of the economy, the sector has a large overall impact, notably because manufacturing employees generally have higher productivity than those in other sectors and because of the important role manufacturing plays in generating overseas earnings through exports and developing skills.

The gloomy messages from the majority of people in the survey support the view from the government’s Office for Budget Responsibility that Brexit has harmed the economy.The OBR estimates that the new trading arrangements between the UK and EU, set out in the trade and co-operation agreement that took effect in January 2021, will reduce long-run productivity by 4 per cent relative to remaining in the EU, while reducing both exports and imports by some 15 per cent.

In June, the Resolution Foundation, a think-tank, said: “Brexit has damaged Britain’s competitiveness, and will make us poorer in the decade ahead.”

The manufacturing trade body MakeUK said: “There is no doubt that leaving the EU has made life much more difficult for manufacturers and there is some evidence among our own data that foreign companies with British plants are now channelling investment away from the UK... The main effort now must be to try and ensure as smooth a trading relationship as possible.”

Commenting on the survey, the Department for Business, Energy & Industrial Strategy said that as a result of the trade and co-operation agreement with the EU “many businesses can benefit from tariff-free trade when exporting” to the bloc, while the government’s Brexit freedoms bill would remove about £1bn worth of “needless red tape”, unlocking investment and innovation.

The Department for International Trade said: “Through our export support service and export academy, we are helping more businesses across the country seize new opportunities in the world’s fastest growing markets. Our export strategy is giving businesses the tools they need to become a nation of exporters.”

Publicly quoted firms sidestep Brexit questions

The Made Here Now survey of views over Brexit mainly reflects the positions of privately owned businesses, with larger manufacturers that have a stock market listing mostly choosing to stay silent.

All but one of the respondents to our survey are from companies with a relatively small number of private shareholders, where the majority owner is often an individual or a family. Quoted companies, which tend to be bigger, are usually reluctant to comment on politically charged topics, worrying that any negative thoughts could upset government ministers and officials.

In addition, larger quoted companies are more likely to have some of their operations overseas, which can help to insulate them from the negative effects of Brexit. They will probably also have more staff and resources to iron out Brexit-related issues such as extra paperwork for exports and imports.

While Rolls-Royce, Halma, Renishaw, Bentley Motors (part of Germany’s Volkswagen) and Rotork all declined to say how the EU departure had affected them, BAE Systems, Spectris, Melrose, Goodwin, Spirax-Sarco and the UK arm of Germany’s BMW did not respond to Made Here Now’s invitations to comment.

JCB - the privately owned maker of construction equipment controlled by the family of its chairman Lord Bamford, a prominent Conservative party donor and confidant of former prime minister Boris Johnson - declined to take part in the survey.

Of the 54 companies that replied to our questionnaire, 80 per cent agreed to have their comments attributed to them, while the rest opted for anonymity. Among the respondents, 42 per cent make industrial products and components, 20 per cent make machinery, 17 per cent consumer items, 9 per cent textiles, 6 per cent food and drink and 6 per cent medical and health products. Eight of the companies in the survey are Made Here Now sponsors.

Some 28 per cent of respondents are based in the English Midlands, 22 per cent in the south-east of England, 20 per cent in the north-east, 15 per cent in the south-west, 7 per cent in the north-west and 4 per cent each in East Anglia and Northern Ireland. Scotland and Wales were not represented.

Tangled supply chains plunge many firms into “nightmare”

Stage fright: Plunge Creations which makes props and other artefacts for theatre and film production says some customers based in continental Europe have started sourcing from the EU rather than UK

Stage fright: Plunge Creations which makes props and other artefacts for theatre and film production says some customers based in continental Europe have started sourcing from the EU rather than UK

The impact of Brexit on supply chains and the way post-Brexit regulations have further disrupted them have caused headaches for many manufacturers.

Inevitably, companies that do much of their business in Continental Europe report some of the worst problems, both in exporting products and services and in sourcing materials, components and semi-finished items.

Among the companies trying to work through the difficulties is Plunge Creations, which makes props and stage designs for sectors including advertising and entertainment. Sarah Mead, a director of the West Sussex company, says: “We might work with a London-based gaming company [for] which we fabricate a number of sculptures or displays that are then sent out to the EU and will tour around various gaming conferences.

“Due to the new regulations around the movement of goods, and also that our customers, and their clients, have to pay taxes on the products, they have become unaffordable. Large contracts that we regularly received are being scaled back… [Our former clients] are using creative fabrication companies in the EU instead.”

Rowan Crozier, managing director of Birmingham component manufacturer Brandauer, says: “Movement of goods over [European] borders [has been a] complete nightmare managed only by using groupage [dedicated transport where space is shared] which is three-to-six times the normal cost.”

Rowan Crozier of specialist components maker Brandauer describes Brexit as a “nightmare”

Rowan Crozier of specialist components maker Brandauer describes Brexit as a “nightmare”

The experience of Andrew Churchill, executive chairman of JJ Churchill, is similar. The company, based in Market Bosworth near Leicester, makes turbine blades for aerospace customers. A typical blade is cast in Italy, sent to the UK for machining, transferred to Eire for coating, returned to UK for more work and then sent to Germany. Some blades require an extra stage along the way in which a special coating is added by a German contractor.

The impact of Brexit on this convoluted supply chain, Churchill says, has led to unpredictability, delays and extra cost as the blades cross multiple borders. “[We are faced with] massive complications that didn’t exist before.”

The criss-crossing of jet engine parts around European countries during different fabrication stages is a lot less feasible than when the UK was part of the European trading bloc, says Andrew Churchill, chairman of JJ Churchill

The criss-crossing of jet engine parts around European countries during different fabrication stages is a lot less feasible than when the UK was part of the European trading bloc, says Andrew Churchill, chairman of JJ Churchill

Steve Fooks, director of New Venture Models, a Kent based producer of architectural models, points to problems over both outwards and inwards deliveries. On exports, some of the couriers his company previously used refuse now to travel to Europe “as there is far too much paperwork to make it worthwhile”. Kenton Robbins, managing director of plastics packaging producer PFF, says: “Materials [from the EU] are being delayed. Suppliers are having to send them twice with two different couriers to be sure of arrival. If we want to do trials of new materials, there’s no certainty they will turn up…. It is stonkingly difficult and hugely painful.”

James Stansfield, chief executive of air-cleaning equipment producer Filtermist, counts his company as a successful exporter –the company sells to 60 nations including several in the EU, with China and the US its biggest export markets. However, even with Filtermist’s expertise in selling around the world, it has found the previously “incredibly simple” process of selling to the EU much more difficult.

Often underestimated, he says, are the challenges faced by many EU-based customers of UK companies in understanding the new rules. These difficulties, says Stansfield, add another set of impediments to trading that many outsiders have failed to appreciate.

“A lot of our EU customers haven’t got the resources to understand the new way of working. A couple of our customers have even decided to buy through a third party because they didn’t have the in-house resource to understand and deal with the extra administration. Our own export teams have been having to walk customers through the process, becoming overnight export experts to enable business to continue.”

Tony Attard, chairman of Panaz, a Lancashire maker of specialised fabrics, says Brexit has cost the company “millions of pounds in lost revenue”. Panaz has struggled to maintain relationships with European business partners and has seen European exports fall by 20 per cent.

Asked to offer his advice to the government, Attard says: “Rejoin the EU. And recognise the massive mistake. Or the UK will not recover for some years.”

Through the clouds, some manufacturers glimpse Brexit’s “sunlit uplands”

Chris Greenough of SDE Technologies sees some upsides to Brexit - including a resurgence in “reshoring”. The company sets great store on boosting employee skills, as in the training centre pictured here

Chris Greenough of SDE Technologies sees some upsides to Brexit - including a resurgence in “reshoring”. The company sets great store on boosting employee skills, as in the training centre pictured here

While the overall message from the Made Here Now poll on Brexit is that leaving the European Union has damaged UK manufacturing, not everyone shares this downbeat view. Just over a quarter of respondents were neutral, indicating that for them negatives balanced out the positives or that the change had made little difference to their prospects.

Among those in this camp is Chris Greenough, chief commercial officer of SDE Technologies, a component maker in Shrewsbury. Although Greenough has seen the downsides to leaving the trading bloc - such as extra paperwork for selling or buying from EU partners – he cautions against being too downbeat.

He is enthusiastic about the potential for the UK to become more self-sufficient in manufacturing – at least in some sectors – due to exporting and importing becoming more difficult. “Now, there is the chance for Brexit to finally have a positive effect, with many businesses looking to reshore and make in the UK for the UK market,” he says.

Also adopting a “glass half full” stance is David Osborne, managing director of bathroom equipment manufacturer Roman Showers, based near Durham. “We have had to make one minor change to our paperwork [for selling to Europe] and that was it. Our exports into the EU continue to grow strongly – our sales are mostly ‘capability-based’ so we have experienced no negative sentiment.”

Roman Showers makes bathroom products in a plant in Newton Aycliffe. Its managing director says Brexit has led only to “minor” changes in its trading procedures

Roman Showers makes bathroom products in a plant in Newton Aycliffe. Its managing director says Brexit has led only to “minor” changes in its trading procedures

Osborne has high hopes for the UK’s planned entry into the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, a trading bloc covering mainly Asia-Pacific. “CPTPP represents a huge opportunity,” he says.

However, since leaving the EU, the UK has disappointed those hoping to see a spate of trade deals with other countries. So far it signed just three trade agreements -with Australia, New Zealand and Singapore – and has admitted that a much-heralded deal with the US is unlikely in the near future. On the CPTPP, the UK hopes to conclude negotiations to join by the end of 2022.

Matt Quartley, managing director of Valeport, a producer of marine instruments in Totnes, Devon, says he has seen some downsides to Brexit, chiefly through logistics providers and couriers in the EU being “woefully underprepared” to treat the UK as a separate country rather than part of the union. “[But] these were not critical issues, just minor administrative burdens,” he says.

Unlike some others, he has seen “no negative impact on our relationships with EU customers, logistical issues notwithstanding”. Quartley adds: “There has been no antipathy towards us or our products at a personal or business level; any perceived antagonism between UK and EU after Brexit would appear to be very much at a political rather than practical level.”

While such thoughts may well cheer some Brexit supporters, others will also find encouraging the views of Peter Davies, chief executive of Sandwell engineering group James Lister. He says that that a clear positive for UK manufacturing has been signs that some factory production that had moved offshore was returning to the UK.

However, he suspects this “reshoring” has been driven less by the changes triggered by Brexit and more because big industrial groups that sell to the UK have become worried about supply chain disruption in the aftermath of Covid.

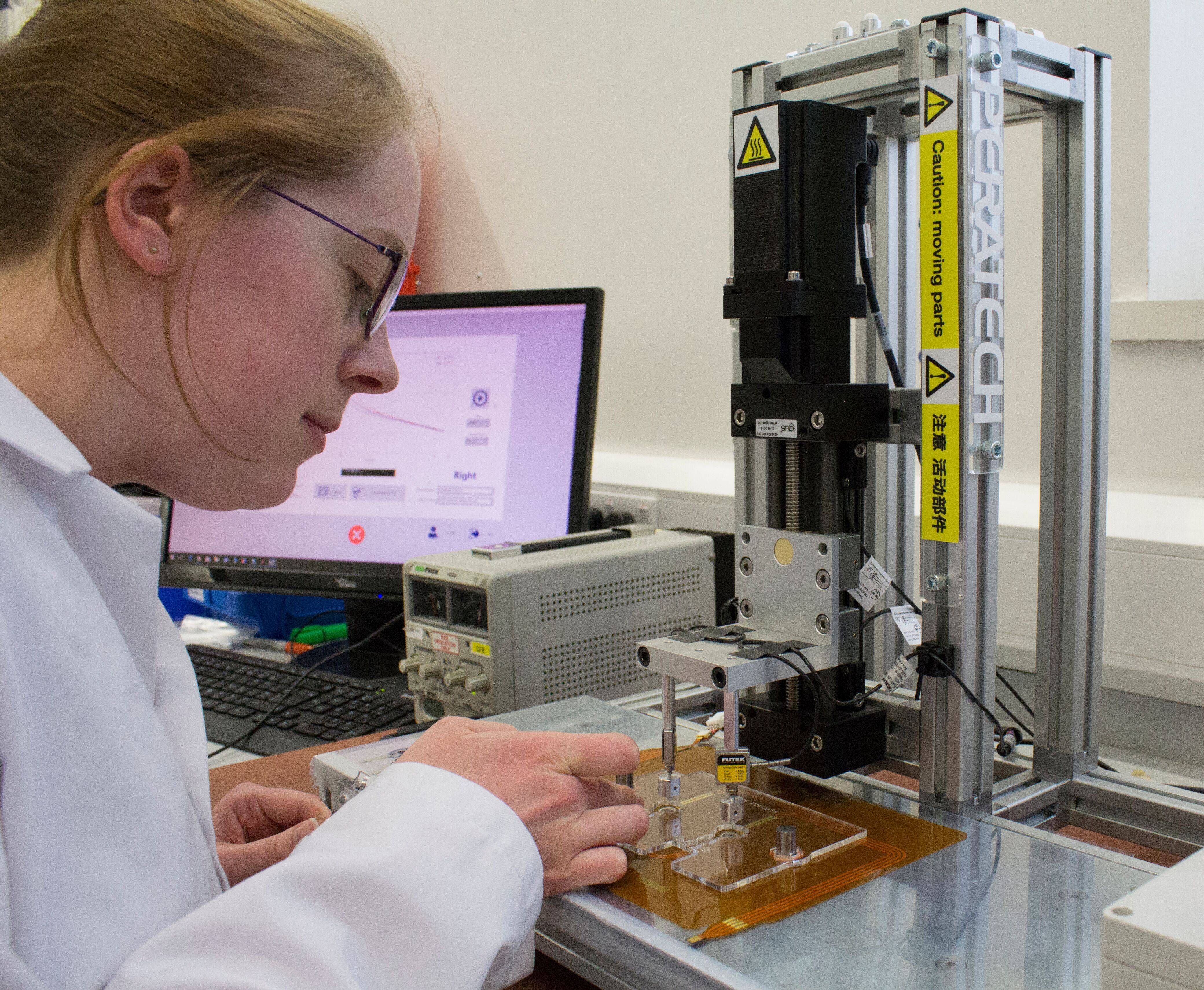

Jon Stark, chief executive of sensor maker Peratech, offers a balanced view of Brexit, his view influenced by the fact that most of his customers are in Asia and the US rather than Europe. “Obviously, working with Europe was going to be more challenging, but anyone with eyes open knew that was going to be the trade-off.”

As for the future, he advises against becoming fixated on Brexit-related problems. For many companies, including Peratech, other issues “including a global pandemic, the disruption of global supply chains, and the fractures in globalisation” loom much larger than Brexit, he says. Stark’s point is echoed by Neil Burns, managing director of Croft Filters, which makes specialised industrial equipment. While Burns says exporting “is so much more difficult” than previously, it is “impossible to blame Brexit alone when we have the cocktail of Brexit, Covid, Putin, fuel costs and inflation”.

Inside Peratech: the chief executive of the sensor maker advises against becoming fixated on Brexit. For many companies other global difficulties including the impact of the Ukraine war loom much larger than Brexit, he says

Inside Peratech: the chief executive of the sensor maker advises against becoming fixated on Brexit. For many companies other global difficulties including the impact of the Ukraine war loom much larger than Brexit, he says

But Will Butler-Adams, managing director of Brompton Bicycle, the UK’s biggest bike producer, does not mince his words when it comes to discussing the fallout from the EU exit – its impact has been highly negative, he says. “Small businesses in Europe decided to stop supplying us as the bureaucracy was too great. We can no longer manage direct consumer sales to Europe. If there are returns it is nearly impossible to reclaim the VAT. Time to ship bikes to Europe has gone from one -two days to five-seven days.”

For all the complaints, Butler-Adams suggests manufacturers focus on the bigger picture. “Brexit is a burden we could do without. But remember companies do not rise or fall due to Brexit. The most important things are ambition, purpose, innovation, culture, people, passion and leadership…Brexit in the grand scheme of running a business is low on the list.”

The stories here are the first in a series on Manufacturing after Brexit. Other articles are being published over the next few days

Manufacturing after Brexit series