The UK’s decision to leave the European Union felt to Mark Adams like a big personal and business setback. Adams is managing director and part owner of Vitsoe, a manufacturer based in the Midlands selling modular shelving systems.

Of Vitsoe’s £15m revenues in 2021, exports – to 70 countries – accounted for more than two-thirds. Adams says Brexit has made trading with both the EU and elsewhere “more difficult”. Even so, since the vote to leave the EU in 2016, Vitsoe has achieved substantial growth, with sales having increased from £6.9m in 2016, and employment rising from 60 in that year to 82.

But Adams insists that – despite his own firm’s good record – Vitsoe has withstood the negative effects both of Brexit and the Covid pandemic only because of the company’s special characteristics which have not necessarily applied to other businesses. “Brexit has been – and continues to be – an impediment to growth,” he says.

The key reasons for Vitsoe’s expansion include, according to Adams, having its supply-chain in the UK and northern Europe rather than Asia. The company has been favoured by its policy of selling directly to customers rather than being dependent on third-party retailers over which it has little control. A third factor is having had since about 2005 a digital-based ordering and production system that has made the company highly efficient.

While the US is Vitsoe’s biggest market, Adams has followed pan-European thinking for a long time. “Following the 1975 referendum [when the UK endorsed its earlier decision to join the EU in 1972] I checked into Bordeaux University during my gap-year in 1980, because I felt that ambitious Brits should learn a language decently,” says Adams. “Since my arrival at Vitsoe in 1986 we have built a business based on open European borders – for goods and people.”

But after the “leave” vote, Adams feels that much of the platform for this way of running a company has fallen away, with negative effects for many manufacturers. He recounts that in 2016 Vitsoe employed 15 nationalities, with most its employees at its HQ and manufacturing centre in Leamington Spa, with others in the US and Germany.

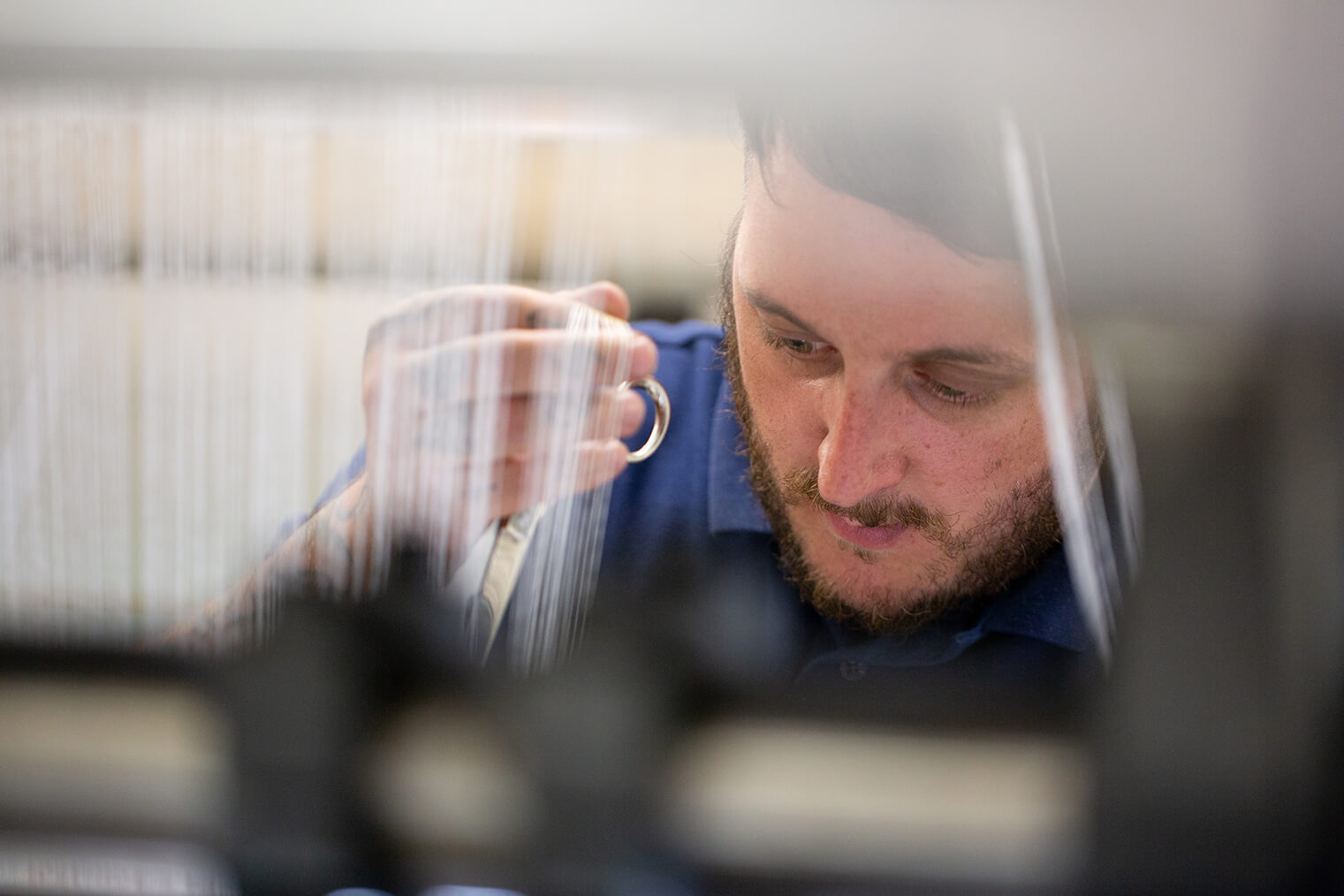

On the shelf: Many of Vitsoe's European customers have reacted with "incredulity" to the UK decision to leave the economic bloc, says its managing director

On the shelf: Many of Vitsoe's European customers have reacted with "incredulity" to the UK decision to leave the economic bloc, says its managing director

Following the vote, five non-UK employees – from Norway, Denmark, Sweden and Portugal – left their jobs in the UK, after “feeling less welcome [in this country]”. The fact that Vitsoe has increased its global headcount significantly is he says down to a “[recruitment] team working exceptionally hard in highly adverse condition”. Adams adds: “We have shed blood and tears to recruit, working flat out all the time.”

As for selling to the US Adams says even these shipments have suffered from Brexit-related constraints. “We have had containers delayed on arrival in the US because they are now subject to further checks [on the grounds that they] are not coming from the EU.” As another example of the new regulatory headaches, Adams mentions delays over registering the US trademark for Vitsoe products.

“[New trademark registrations] were rejected on the grounds that Vitsoe had used in evidence the existence of EU trademarks. We had to reapply using [UK-only] trademarks. Even our lawyers were surprised.”

Adams adds: “I have witnessed the incredulity shown by Europeans towards the Brexit decision. Our erosion of soft power is plain to see. We used to be respected for being the necessary thorn in the side of the EU. We are no longer that and, critically, we are no longer at the table where the important decisions are taken.”

Simon Spinks, chairman of Harrison Spinks, a Yorkshire bed and mattress maker, also laments what he sees as an ebbing away of the UK’s position as a serious political and economic player in Europe. “For me the greatest negative is around security in the very long term. Being a member of the EU binds the economies of Europe together which is a deterrent for irreconcilable disagreement.”

John Stimpson, business manager at Heathcoat Fabrics, which makes technical textiles for industries such as aerospace and automotive, perceives the negative impact of Brexit as having played out gradually, affecting the mindset of global firms with which his company previously had good relations. He lists eight reasons why Brexit has made life harder for his company, including transportation delays and higher administration costs.

Heathcoat Fabrics is a big Devon-based maker of specialised textiles - the company says some of its EU customers have started to rethink their use of UK suppliers

Heathcoat Fabrics is a big Devon-based maker of specialised textiles - the company says some of its EU customers have started to rethink their use of UK suppliers

Once knowledge of these difficulties spread to Heathcoat’s international customers, says Stimpson, they started to think twice about placing orders with his company, on the grounds that completing the work may become harder or more expensive. “Major customers are looking for non-UK-based alternatives,” he says.

Evidence that such experiences are part of a broader picture of Brexit damaging sometimes long-standing overseas connections comes from a study at the London School of Economics’ centre for economic performance which examined trade involving 1,200 products exported from the UK to the EU.

The authors found “a sharp drop in the number of trade relationships between UK exporters and EU importers, with lower value relationships hit particularly hard. This finding is consistent with claims that the [new European trading arrangements have] caused many smaller UK firms to stop exporting to the EU”.

Heathcoat uses expert knowledge built up over decades to make textiles for sectors such as aerospace and automotive

Heathcoat uses expert knowledge built up over decades to make textiles for sectors such as aerospace and automotive

Research of this sort fits in with how Greg McDonald, chairman of component maker Goodfish, has seen Brexit play out through what amounts to a series of ripple effects - mainly psychological but with a serious long-term impact.

He feels that after the 2016 Brexit referendum many international businesses perceived – rightly or wrongly – that the UK would be a less reliable business partner. “Key international customers, from Japan and Germany in particular, stopped sending us requests to tender [for specific contracts].”

To make matters worse, other customers that were part of Japanese, German and US groups but had UK operations began shutting their plants, which led to orders being diverted from Goodfish to other countries as a result. McDonald’s company has been able to compensate at least partly through acquiring a UK-based business with a domestically focused set of customers – but nonetheless it has struggled.