Britain’s departure from the European Union has given his company a big boost, says Paul Hancock, chairman and owner of Bowman International, a manufacturer of specialised industrial bearings based near Oxford. “It forced our company to look at ourselves,” says Hancock, “and we have performed better as a result.”

The 85-year-old Hancock – who started his business 50 years ago, just before the UK joined the EU in 1973 – says his experience in coping with numerous recessions and political changes has helped Bowman International adapt to the new environment. He says Brexit encouraged him to refocus on two key points – developing good products and selling them to the world, especially North America.

“A lot of our products aren’t necessarily any better than our competitors, but we go all out to market them,” says Hancock. His view that quitting the political and economic union has helped his company runs contrary to the majority opinion of industrialists who took part in the Made Here Now Brexit survey

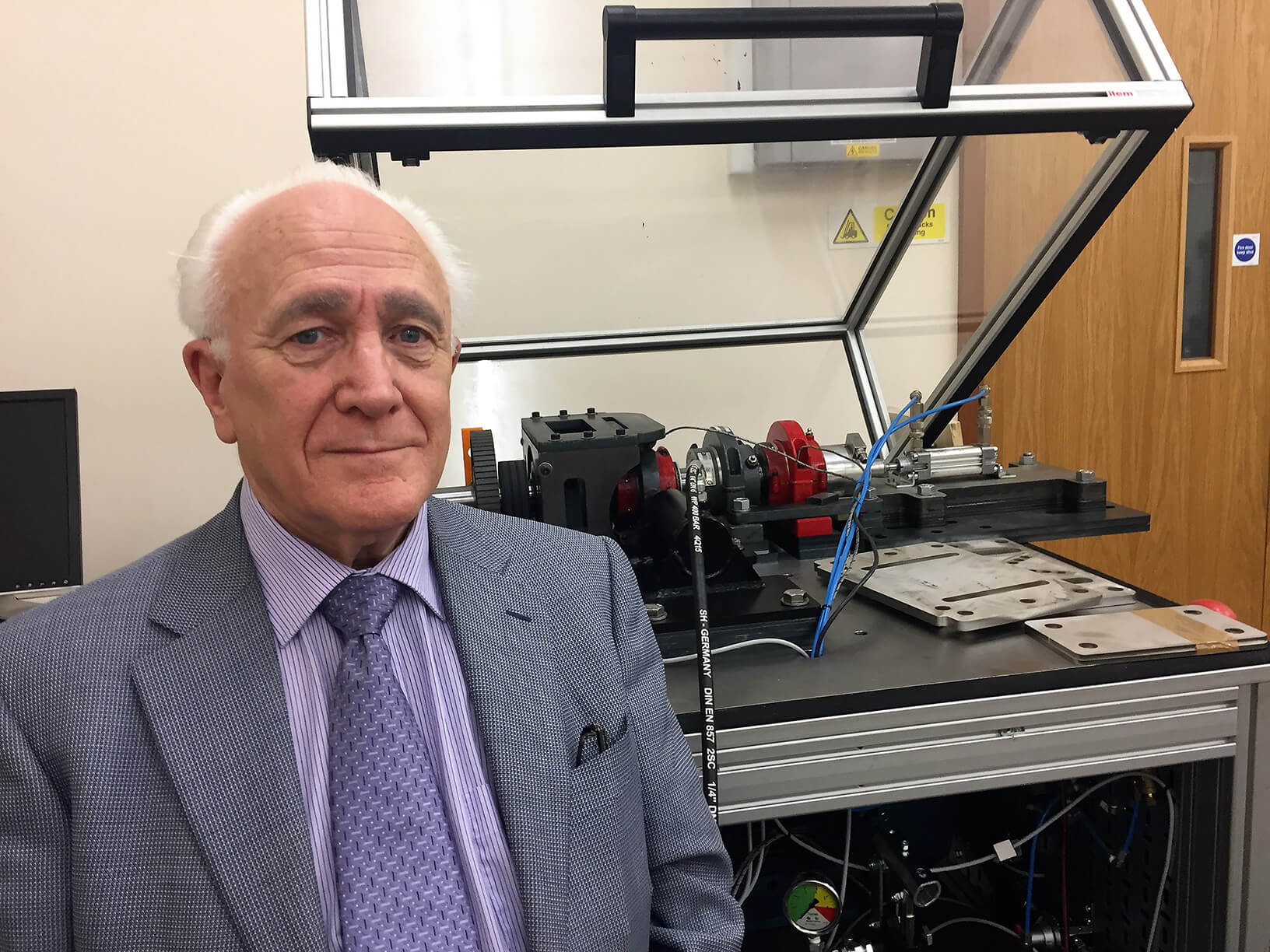

Paul Hancock, Bowman's chairman, says criticism of Brexit shows "how negative and non-aggressive some of our industries are"

Paul Hancock, Bowman's chairman, says criticism of Brexit shows "how negative and non-aggressive some of our industries are"

However, the business veteran has little time for those who argue that the change has been damaging. “[This] shows how negative and non-aggressive some of our industries are,” he says. “They seem to think that business will walk in the door. We diverted a lot of time, effort and cost to covering the US and Canada and it’s paying off. We are also looking for business by replacing imports, especially after all the supply chain difficulties over the last two years.”

The industrial bearings market is extremely competitive and is dominated by global giants including SKF of Sweden, Germany’s Schaeffler and Timken of the US. However, Hancock’s company has won business partly through focusing on specialist niches such as bearings used in wind turbines that are easier to maintain and replace than their rivals. It has also benefited from the weakness of sterling against other major currencies. Since the UK voted to leave the EU in mind-2016, the pound has fallen 22 per cent against the dollar and 10 per cent against the euro.

Bowman has increased sales to £10.6m in the year to September 2022, up from £9.4m in 2020/21 and £8.25m in the previous year. Hancock reckons sales could grow to £15m - £20m within three years. Exports – close to zero 15 years ago – climbed to 27 per cent of revenues in 2021/22 and could rise soon to up to 50 per cent.

Industrial bearings are key parts inside many types of heavy machines

Industrial bearings are key parts inside many types of heavy machines

Of Bowman’s £3m of exports in the company's last financial year, half went to the EU and £1m to the US. Hancock believes US revenues could reach almost £3m in the coming year.

“We opened our own office in the US near Chicago, and we have secured $1m of business so far with a lot more lined up. The new products are attracting a lot of attention,” he says.

“Some smaller [UK] companies who rely totally on imports and/or exports with the EU will be hurt, so diversification is the name of the game.”

While putting a greater emphasis on North America, Bowman also shut its office and warehouse in Germany, saving money. “We still view exporting to Germany as important. While in the past couple of years we have lost some business in Germany, cutting our internal presence in the country has meant the sales we are now making there are more profitable.”

Bowman's boss reckons employment could increase significantly on the back of healthy demand

Bowman's boss reckons employment could increase significantly on the back of healthy demand

One underlying reason for the company’s relative success, Hancock believes, is that it is “run by technical people, not accountants”.

Explaining this, he says Bowman routinely keeps in stock up to 7,000 families of bearings made both by itself and other suppliers. “If customers want a specific type of bearing, the chances are we can sell to them immediately, rather than wait for it to be made or come into our warehouse. We don’t have a problem in keeping stock numbers high.”

Hitting pay dirt: a move to shift focus to US sales has worked out for the Oxfordshire company

Hitting pay dirt: a move to shift focus to US sales has worked out for the Oxfordshire company

Being privately owned, Bowman does not have to worry about outside shareholders scrutinising its accounts and complaining about things they dislike. Most publicly quoted manufacturing businesses are wary about maintaining high levels of “work in progress” such as warehouse stocks, on the grounds that financiers may view this as an inefficient use of capital.

Bowman employs just 43 people, but he reckons this could expand greatly if sales rise as he hopes. Another factor that could affect employment is that the company wants to start making some of the products it currently buys in, particularly goods from China. “I am hell-bent on bringing back production from China and I feel confident we can do it,” he says.

Keeping the wheels turning: without bearings most agricultural equipment would grind to a halt

Keeping the wheels turning: without bearings most agricultural equipment would grind to a halt

On the back of such plans, Hancock suggests Bowman’s workforce could rise to 100-200 in the next three years, on the assumption that the company could finance expansion through bank loans or similar and find enough skilled people.

The company has invested heavily in high-performance 3D printing machines from Hewlett-Packard in the US. Components made using these machines are used internally and sold externally, providing useful revenue to supplement bearing sales. “The 3D printing business is going berserk,” Hancock says.